Table of Content

Pre-approval is therefore useful when you have less time and a shorter transaction window for the process. You don’t need to be pre-qualified to start looking at houses, but many real estate agents like to see at least a pre-qualification letter before committing a lot of time and effort to showing you homes. A mortgage pre-approval is not the same as a pre-qualification, but they serve many similar purposes. Both help you estimate the loan amount you’re likely to qualify for.

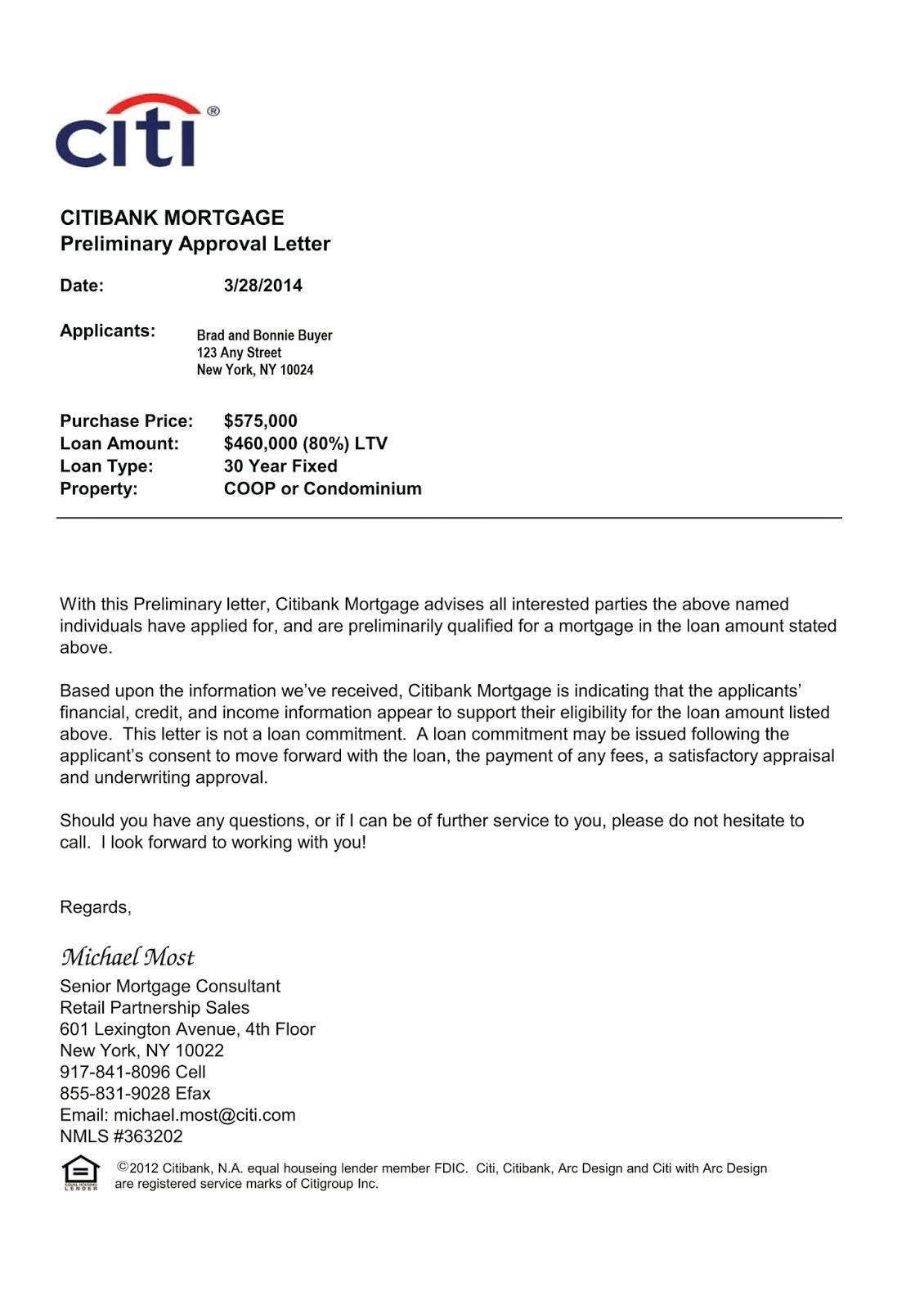

The reason pre-approvals are prevalent at auctions is because they provide evidence to the seller that you are serious about the purchase, and they allow you to bid with awareness of what you can afford. There are certain steps it pays to take when you embark on a home search. You should spend some time interviewing real estate agents, make a wish list of the home features you're looking for, and get pre-approved for a mortgage. Some buyers, however, don't take that final step, either because they don't know about it or because they don't understand how it works. Here are a few things you should know about mortgage pre-approval. During the process, most lenders will run a hard credit check to assess your finances, so make sure your credit score is in good shape.

Want To Learn More About Buying A Home

Sellers will always be wary of buyers without a lender’s backing, so a letter of pre-approval can help your offer stand out. If your credit score falls below 580, you will be considered a heavy risk to lenders and won’t be likely to secure a mortgage. Pre-approval is not a guarantee, but it is also not a commitment. Just as lenders reserve the right to reject your application, you’ll still be able to back away from the mortgage process without consequence.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. If your loan application is denied post pre-approval it may be best to withhold from immediately placing another application. Each time you apply for pre-approval, or a loan, this will be marked on your credit report as an enquiry.

BMO Harris personal loan review: Small loans and broad...

A pre approval home loan is a loan that is given to a borrower by a lender in order to help them purchase a home. This type of loan is usually given to borrowers who have good credit and a steady income. The interest rate on a pre approval home loan is usually lower than the interest rate on a regular home loan. And when you’ve found the right property, you can start the formal approval process for your home loan.

If any of these apply to you, the pre-approval process can be much longer—anywhere from a few days to several months—depending on the complexity of your finances. We think it's important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Lenders partner with credit reporting agencies to obtain marketing lists for pre-approval offers.

Knowing your buying power

Pre-approval marketing can provide a potential borrower with an estimated interest rate offer and a maximum principal amount. During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

But a preapproval is only a conditional green light that you’ll qualify for a specific loan; it doesn’t guarantee final loan approval. Final loan approval is contingent on other conditions and specifics. For example, the lender will likely want to approve the specific car or home you’re purchasing before approving the funds.

But remember that just because youve been preapproved for an amount doesnt mean you have to borrow the maximum. Thats because many mortgage lenders use your gross monthly income as a factor in determining how much you qualify for. A pre approval home loan is a mortgage that has been pre-approved by a lender.

Starting over with a new buyer is a time-consuming and costly hurdle that home sellers and their real estate agents will always seek to avoid. A letter of pre-approval indicates to sellers that a potential buyer is committed to buying a home and is motivated to complete the sale. The added assurance from a qualified lender shows that adverse events are unlikely, and the transaction can be expected to conclude free of unexpected hurdles. Lenders will use your debt-to-income ratio to decide if your financial situation can afford the added expense of a mortgage loan. DTI is calculated by taking the total of the borrower’s monthly debt payments, divided by their gross monthly income.

Large financial commitments, like property, can be both exciting and intimidating – particularly for first home buyers. Luckily, home loan pre-approval may help you to put your best foot forward. So, let’s break down the ins and outs of home loan pre-approval and the process to obtain one.

In a mortgage loan, the secured capital may also need a current appraisal which will usually affect the total principal offered. Make sure that the prospective lender has accurate information, particularly on income and liabilities that you may have. You can ask to see the credit report that the lender used, and if you believe that it contains errors, you can contact the relevant credit bureau. Youll also need to contact the company that provided the information.

Pre-approval, also known as approval in principle or conditional approval, is when a lender agrees to extend you a home loan up to a certain limit, subject to certain conditions. Here at Westpac, we refer to conditional approval or pre-approval as approval in principle. You can work out how much you may be able to borrow before either approval stage without affecting your credit history, by completing an application online. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site.

No comments:

Post a Comment