Table of Content

Receiving a pre-approval offer does not guarantee that a borrower will qualify for the offered loan. Then, you can work backward using todays mortgage interest rates to determine your maximum home buying power. Its important to take certain steps before kicking off the mortgage loan process.

Your preapproval shows sellers you have the income and credit to complete the sale. After analyzing your preapproval application, credit and other information, the lender will let you know if you’re preapproved for a loan. If you are, the lender will usually let you know the total amount you’re preapproved for. In fact, it often makes sense to borrow less than what a lender is willing to let you borrow. To obtain a pre-approved loan a borrower must complete a credit application for the specific product. Some lenders may charge an application fee which can increase the costs of the loan.

Home loan pre-approval – what you need to know

A mortgage par rate is the standard interest rate calculated by an underwriter based on a borrower's credit application for a specific mortgage loan. Once a borrower completes the credit application the lender will verify their debt-to-income and do a hard inquiry analysis of the borrower’s credit profile. And dont forget another key step to buying a home is properly insuring it. Your mortgage lender may recommend you an insurer, but its up to you to find the right provider that best fits your needs and thats where we come in! At American Family, you can control what you pay for insurance by customizing a homeowners policy built around you. Reach out today, our agents are ready to help discuss the best ways to protect your hard-earned dream.

Mortgage pre-approval and pre-qualification are not interchangeable. Opinions expressed on this site are the author's alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. Auto, homeowners, and renters insurance services offered through Karma Insurance Services, LLC (CA resident license # ). Mortgage preapprovals and prequalifications are different.Learn more about the difference between preapproval and prequalification. Investopedia requires writers to use primary sources to support their work.

How To Get Pre

However, unlike the name suggests, mortgage pre-approval does not mean you will automatically secure a loan for any home you want. Rather, it refers to the process of figuring out how much money you can borrow to purchase a home. You can definitely offer more than the pre-approval, if you feel that the seller's asking price is justified. Just know that your mortgage lender will probably stick to the amount they pre-approved you for in the first place .

PNC Bank has a customer-friendly website full of educational resources about home borrowing, but the companys online efforts dont stop there. It earned our top rankings for providing loan details on its website and making it easy to apply online. In short, getting preapproved for a mortgage signals that youre a serious buyer.

What documents and information are needed for a mortgage pre-approval?

A co-signer is responsible to make your mortgage payments if you can’t, however, so this option should not be undertaken lightly. You can contact various mortgage lenders to find out how much you’ll be approved for and what interest rates they’re offering. Alternatively, you could seek out the assistance of a mortgage broker who will shop around on your behalf. Mortgage pre-qualification should not be confused with pre-approval.

Lenders send high volumes of pre-approval qualifications for credit cards, auto insurance, or private loans, for example, each year through both direct mail and electronic mail. It can usually be done online or over the phone, and the whole process is often over in less than a day. You typically supply your bank or lender with some basic financial information in the form of a verbal or written approximation, and they give you an estimate of how much you can likely borrow. The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

Does pre-approval mean Im approved?

It also sets realistic parameters around how much you can afford to borrow if your application is approved. You must possess all the required sets of documents required for getting pre approved for a house loan. According to Zillow’s Consumer Housing Trends Report 2022, 85% of sellers say that they prefer to accept an offer from a buyer that is pre-approved. If you haven’t saved 10%, that’s a good sign you shouldn’t buy a house. Having 10% is the minimum, but a down payment of 20% should be your goal!

See if you qualify as a first-time home buyer, find government help and get tips for choosing the right mortgage. What many people don’t realize is that there’s a difference between pre-qualification vs. pre-approval. Knowing how the two work could help you during your home search.

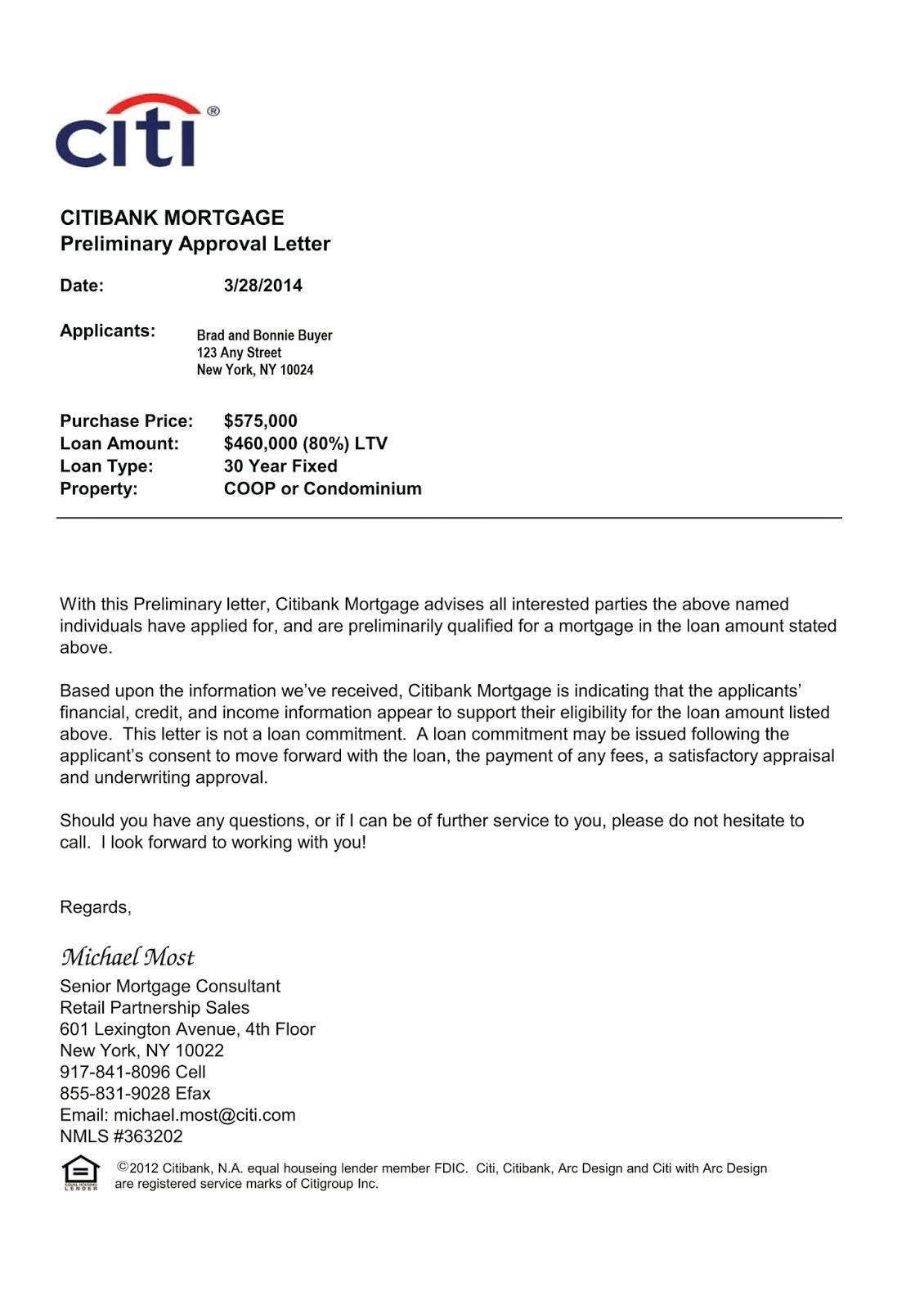

The credit application will require a borrower’s income and social security number. A mortgage preapproval is a letter from a lender indicating that you are tentatively approved for a loan. It typically includes a maximum loan amount, interest rate and any other relevant terms or information.

Plus, you’ve got an official letter from your lender saying so that will speak volumes to a seller. As a bonus, a pre-approval letter can also put you ahead of other potential buyers who have yet to secure pre-approval, as the seller will likely consider your offer more seriously. Money's Top Picks Best Personal Loans Over 170 hours of research determined the best personal loan lenders.

Always speak to a financial advisor if you are unsure of your options. A pre-approval that includes a bank assessment is likely to provide you with a more concrete estimation of your borrowing power. Pre-approval, sometimes referred to as conditional approval or approval in principle, is an indication from your lender of how much you may be able to borrow. Rather, pre-approval can help you to narrow your search and eventually place an offer with confidence.